Mastering Southwest Credit Cards: Which Card Fits Your Travel Style?

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

Introduction to Southwest Credit Cards

Southwest Airlines fans are sure to realize the value that co-branded credit cards can offer. Southwest Airlines has partnered with Chase to offer a suite of credit cards designed to enhance the travel experience for its customers. These cards offer a variety of benefits, including the ability to earn Rapid Rewards points, anniversary bonuses, and travel credits. Which.

In this article, we’ll explore the available Southwest Rapid Rewards credit cards, their privileges, application nuances, and analyze the ideal user profile for each card.

Overview of Southwest Rapid Rewards Credit Cards

Southwest offers both personal and business credit cards to cater to a wide range of travelers. As of February 2025, the following cards are available:

Personal Southwest Сredit Сards

Southwest Rapid Rewards Plus Credit Card

- Annual Fee: $69

- Sign-Up Bonus: Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Earning Rates: 2X points on Southwest purchases and 1X points on all other purchases.

- Anniversary Bonus: 3,000 points each year.

- Foreign Transaction Fees: Yes, 3% of each transaction in U.S. dollars.

- Additional Benefits: 25% back on in-flight purchases.

Southwest Rapid Rewards Premier Credit Card

- Annual Fee: $99

- Sign-Up Bonus: Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Earning Rates: 3X points on Southwest purchases and 1X points on all other purchases.

- Anniversary Bonus: 6,000 points each year.

- Foreign Transaction Fees: None.

- Additional Benefits: 25% back on in-flight purchases.

Southwest Rapid Rewards Priority Credit Card

- Annual Fee: $149

- Sign-Up Bonus: Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Earning Rates: 3X points on Southwest purchases and 1X points on all other purchases.

- Anniversary Bonus: 7,500 points each year.

- Foreign Transaction Fees: None.

- Additional Benefits: $75 annual Southwest travel credit, 4 upgraded boardings per year (when available), and 25% back on in-flight purchases.

Business Southwest Сredit Сards

Southwest Rapid Rewards Premier Business Credit Card

- Annual Fee: $99

- Sign-Up Bonus: Earn 60,000 points after spending $3,000 on purchases in the first 3 months from account opening.

- Earning Rates: 3X points on Southwest purchases, 2X points on local transit and commuting, and 1X points on all other purchases.

- Anniversary Bonus: 6,000 points each year.

- Foreign Transaction Fees: None.

- Additional Benefits: 25% back on in-flight purchases.

Southwest Rapid Rewards Performance Business Credit Card

- Annual Fee: $199

- Sign-Up Bonus: Earn 80,000 points after spending $5,000 on purchases in the first 3 months from account opening.

- Earning Rates: 4X points on Southwest purchases and 2X points on purchases for your business in select categories.

- Anniversary Bonus: 9,000 points each year.

- Foreign Transaction Fees: None.

- Additional Benefits: In-flight Wi-Fi credits, 4 upgraded boardings per year (when available), Global Entry or TSA PreCheck fee credit, and 25% back on in-flight purchases.

Benefits of Southwest Airlines Сredit Сards

Image source – Southwest Media

Southwest Airlines has several co-branded credit cards with Chase, each designed to make your travel more enjoyable and reward your loyalty. Here’s a breakdown of what each card offers:

1. Rapid Rewards Points

All Southwest credit cards let you earn Rapid Rewards points on your purchases:

- Southwest Purchases: 2X to 4X points per dollar.

- Everyday Spending: 1X point per dollar.

You can redeem these points for flights, hotel stays, car rentals and more through Rapid Rewards.

2. Anniversary Bonus Points

Southwest credit cards give you bonus points on your card member’s anniversary:

- Plus Card: 3,000 points.

- Premier Card: 6,000 points.

- Priority Card: 7,500 points.

- Premier Business Card: 6,000 points.

- Performance Business Card: 9,000 points.

These points are added to your Rapid Rewards account automatically each year.

3. Annual Travel Credits

Some cards offer annual travel credits to offset travel expenses:

- Priority Card: $75 Southwest travel credit.

- Performance Business Card: $100 Global Entry or TSA PreCheck application fee credit.

These credits can be used on various travel-related purchases to increase the value of the card.

4. Upgraded Boardings

Get upgraded seats with upgraded boardings:

- Priority Card: Four upgraded boardings per year when available.

- Performance Business Card: Four upgraded boardings per year when available.

This benefit lets you snag a better seat by boarding earlier.

5. Inflight Discounts

Save on inflight purchases:

- Priority Card: 25% back on inflight drinks and Wi-Fi.

- Performance Business Card: Inflight Wi-Fi credits.

These discounts make travel more enjoyable and affordable.

6. Tier Qualifying Points (TQPs)

Boost your path to A-List status:

- Premier Card: 1,500 TQPs for every $10,000 spent.

- Priority Card: 1,500 TQPs for every $10,000 spent.

- Performance Business Card: 1,500 TQPs for every $10,000 spent. Earning TQPs gets you to elite status which has more travel perks.

7. No Foreign Transaction Fees

Travel internationally without extra costs:

- Premier Card: No foreign transaction fees.

- Priority Card: No foreign transaction fees.

- Premier Business Card: No foreign transaction fees.

- Performance Business Card: No foreign transaction fees.

This benefit lets you use your card abroad without extra charges.

8. Companion Pass Qualification

Points from these cards count towards the Companion Pass which lets you choose one person to fly with you for free (excluding taxes and fees) when you buy or redeem points for a flight. Getting this pass can add a ton of value to your travel.

Each Southwest credit card has its own set of benefits to fit different travel styles and spending habits. Choose the card that works for you and maximize your rewards and travel experience.

Comparative Analysis: Business vs. Personal Southwest Cards

The major differences between the Southwest Rapid Rewards Premier Business Credit Card and Southwest’s personal credit cards are in the rewards structure and targeted user base.

Business cards are designed specifically for business owners who fly Southwest Airlines frequently and offer more business travel rewards than personal cards.

The main differences lie in the enhanced rewards and additional benefits offered by business cards, including the Performance Business Card, which is designed for business travelers who travel frequently and spend a lot of money.

These features include:

- Higher bonus points for purchases at Southwest and Rapid Rewards hotels and car rental partners

- Higher Annual bonuses

- Exclusive travel perks such as upgrades and in-flight internet credits to help optimize business travel

- Free cards for employees

Personal cards, while offering lower annual fees and sign-up bonuses, still provide significant rewards for personal or family travel, making them more accessible to casual travelers.

| Feature/Benefit | Plus Credit Card | Premier Credit Card | Priority Credit Card | Premier Business Card | Performance Business Card |

|---|---|---|---|---|---|

| Annual Fee | $69 | $99 | $149 | $99 | $199 |

| Sign-Up Bonus Points | 50,000 points after spending $1,000 in 3 Months | 50,000 points after spending $1,000 in 3 Months | 50,000 points after spending $1,000 in 3 Months | 60,000 points after spending $3,000 in 3 Months | 80,000 points after $5,000 in 3 Months |

| Sing-Up Companion Pass plus 30,000 Bonus Points Spending $4,000 within the first three months Offer ends 3/31/25 | Yes | Yes | Yes | No | No |

| Anniversary Bonus Points | 3,000 | 6,000 | 7,500 | 6,000 | 9,000 |

| Points Earned on Southwest Purchases | 2x | 3x | 3x | 3x | 4x |

| Points Earned on Southwest and Rapid Rewards hotel and car rental partner purchases | 2x | 2x | 2x | 2x | 3x |

| Points Earned on social media and search engine advertising, internet, cable and phone services. | 2x | 2x | 2x | No | 2x |

| Points Earned on local transit and commuting, including rideshare | 2x | 2x | 2x | 2x | 2x |

| Points Earned on all other purchases | 1x | 1x | 1x | 1x | 1x |

| Foreign Transaction Fees | Yes, 3% of each transaction in U.S. dollars | No | No | No | No |

| EarlyBird Check-Ins per Year | 2 | 2 | No | 2 | No |

| Southwest Travel Credit | No | No | $75 | No | No |

| Fee credit for points transfers per year | No | No | No | No | $500 |

| Tier Qualifying Points (TQPs) | No | Yes, Earn 1,500 TQPs toward A-List status for every $5,000 you spend | Yes, Earn 1,500 TQPs toward A-List status for every $5,000 you spend | Yes, Earn 1,500 TQPs toward A-List status for every $5,000 you spend | Yes, Earn 1,500 TQPs toward A-List status for every $5,000 you spend |

| Upgraded Boardings per Year | No | None | 4 | No | 4 |

| In-flight Purchases Discount | 25% | 25% | 25% | 25% | No |

| Inflight Internet credits per year | No | No | No | No | Up to 365 |

| Employee cards (earn points on employee expenses) | No | No | No | Yes | Yes |

| Up to $100 Global Entry, TSA PreCheck® or NEXUS fee credit Receive a statement credit of up to $100 every 4 years | No | No | No | No | Yes |

| 10,000 boost of Companion Pass qualifying points each year | Yes | Yes | Yes | Yes | Yes |

Choosing the Right Card

Choosing the right Southwest credit card depends on your travel habits and spending:

- Casual Travelers: The Rapid Rewards Plus Credit Card has a lower annual fee and basic rewards for those who fly Southwest infrequently.

- Domestic Flyers: The Rapid Rewards Premier Credit Card has higher earning on Southwest purchases and no foreign transaction fees for regular domestic travelers.

- International Flyers: The Rapid Rewards Priority Credit Card has travel credits and upgraded boardings for those who travel internationally or want more perks.

- Small Business Owners: The Premier Business Credit Card is for businesses with moderate travel needs, with rewards on Southwest purchases and commuting expenses.

- Heavy Business Travelers: The Performance Business Credit Card is for businesses with heavy travel requirements, with higher earnings, in-flight Wi-Fi credits and more perks.

Each card has its benefits so it’s up to you to assess your travel frequency, spending, and desired benefits to decide which one is best for you.

Chase’s 5/24 Rule: What You Need to Know

If you’re applying for a Southwest credit card, you should know about Chase’s 5/24 rule. This unofficial rule means if you’ve opened 5 or more credit cards (from any bank) in the last 24 months, Chase will denied your application for a new card—including Southwest cards.

One thing to note is most business credit cards don’t count towards the 5-card limit, but there are some exceptions.

Being added as an authorized user on someone else’s personal credit card does count towards your 5 card total.

Can You Have More Than One Southwest Card?

If you like Southwest, you might be wondering if you can have multiple Southwest credit cards. Here’s how it works:

- You can only have one Southwest personal card at a time.

- You can have one personal and one business card at the same time.

- If you have a business, you’re allowed to have both Southwest business cards at the same time.

- You can’t have two of the same Southwest business card, even if for different businesses.

Southwest’s 24-Month Bonus Rule

Chase has a 24-month rule for Southwest credit card bonuses. This rule applies differently to personal and business cards:

Personal Cards

You can only earn a sign-up bonus on a Southwest personal card once every 24 months. This means if you’ve earned a bonus on any Southwest personal card in the last two years, you won’t be eligible for another one until that time has passed.

Note the 24-month clock starts when you receive the bonus, not when you open the card. If you’re not sure when you last earned a bonus, you can call Chase customer service and they’ll tell you.

Business Cards

The rules for business cards are a little more lenient. You can earn a sign-up bonus on a Southwest business card as long as you haven’t earned a bonus for that specific card in the last 24 months. But you can earn a bonus on a different Southwest business card within that timeframe.

Keep these rules in mind and you’ll plan your applications strategically and maximize your Southwest Rapid Rewards!

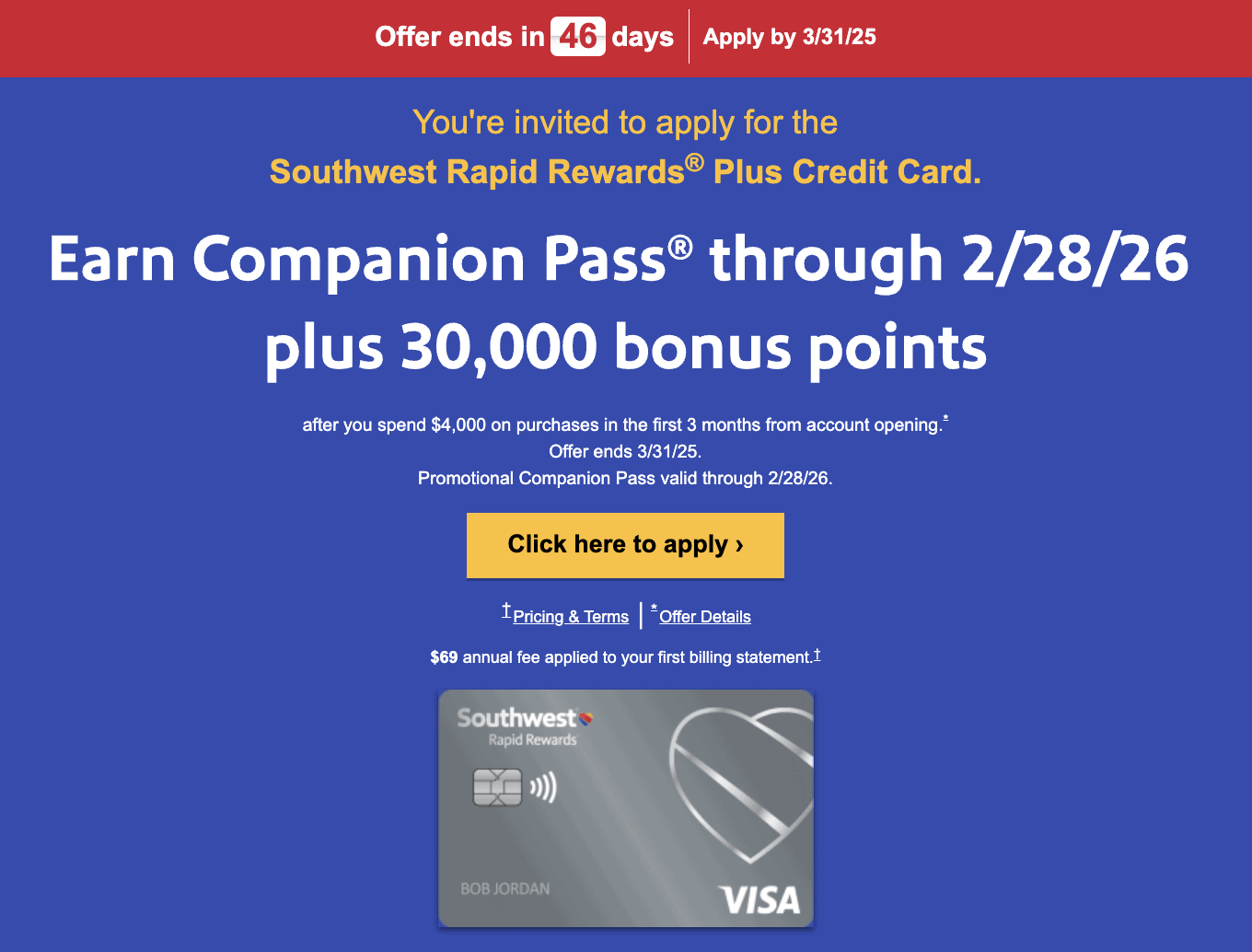

Which Credit Card Offers a Free Companion Ticket?

Now, Southwest is offering a limited-time offer for new personal credit card applicants to get the Companion Pass. To qualify, you need to apply for a personal Southwest credit card and spend $4,000 within the first 3 months. Once you meet this requirement, you’ll get 30,000 bonus points and the Companion Pass which allows you to pick one person to fly with you free (excluding taxes and fees from $5.60 one way), unlimited times whenever you buy or redeem points for a flight. Offer ends March 31, 2025.

The Companion Pass earned through this offer is good through February 28, 2026.

This offer is available on all three personal Southwest credit cards:

- Southwest Rapid Rewards Plus Credit Card

- Southwest Rapid Rewards Premier Credit Card

- Southwest Rapid Rewards Priority Credit Card

Each card has its own benefits and annual fee so be sure to review each to see which one fits your travel style and budget.

Business Southwest credit cards are not included in this offer.

For more info and to apply visit Southwest’s website or reputable financial news sites.

In Сonclusion

Overall, the Southwest Credit Cards offer a range of benefits, from upgraded boarding to anniversary bonus points. If you’re a frequent Southwest Airlines flyer, the Companion Pass alone can make the card worth it. And if you’re looking to earn rewards for travel, the Rapid Rewards points can be a great way to save money on flights and other travel-related expenses.

The Southwest Rapid Rewards Premier Credit Card is ranked #1 and the Priority Credit Card is ranked #2 in their respective segments as the best co-branded airline credit cards in terms of customer satisfaction (according to J.D.Power).

Which Southwest Business Card is Best?

If you fly Southwest a few times a year and want to save on the annual fee, go with the Premier Business Card ($99). If you fly Southwest frequently and want travel perks like upgraded boarding and TSA PreCheck credit, the Performance Business Card ($199) is worth the extra cost.

Both cards help you earn points toward the Companion Pass, so if you're working toward that benefit, picking the right card can make a big difference!

Is a Southwest Credit Card Hard to Get?

If your credit score is above 700, you haven’t opened too many cards recently, and you meet Chase’s 5/24 rule, you have a good chance of getting approved.

Which Is the Best Southwest Credit Card?

Best perks for the cost: Southwest Rapid Rewards Priority Card

Best for Budget Travelers: Southwest Rapid Rewards Plus Card – Lowest annual fee

Best for Business Travelers: Southwest Rapid Rewards Performance Business Card – Most travel perks

If you fly Southwest regularly, the Priority Card is the best value. If you’re looking for a business card, go with the Performance Business Card for premium perks.